A Snapshot of National Debt Burdens Worldwide

The United States has solidified its position as the world’s most indebted nation, carrying a staggering $32.9 trillion in national debt, according to the latest World Population Review report released on October 18, 2025. The US Most Indebted Country status highlights the sheer scale of its financial obligations, dwarfing other economies and sparking debates on fiscal sustainability. Meanwhile, Pakistan ranks 33rd with a debt of $260.8 billion, placing it behind giants like Japan ($10.5 trillion) and China ($10.2 trillion), but ahead of neighbors like Bangladesh ($177.6 billion).

The report has ignited discussions on global debt trends, with the US’s $76,000 per capita debt contrasting Pakistan’s $543. Here’s the full breakdown on the US Most Indebted Country ranking, Pakistan’s position, and what it means for the global economy.

What Sets the United States as Most Indebted Country?

The US Most Indebted Country title stems from its $32.9 trillion debt, equivalent to 123% of GDP, as per the World Population Review’s 2025 analysis. This figure includes federal, state, and local obligations, fueled by decades of borrowing for wars, tax cuts, and pandemic relief. The debt has ballooned from $5.7 trillion in 2000, with interest payments alone projected at $1 trillion annually by 2030, according to the Congressional Budget Office.

READ NEXT: China Military Corruption Purge 9 officers sacked

The US Most Indebted Country status isn’t just numbers it’s a warning. Despite its economic might, the US’s debt ceiling debates in 2025 nearly triggered a default, shaking markets. The ranking underscores the risks of unchecked borrowing, even for the world’s largest economy, where debt service now consumes 15% of the federal budget.

Why Pakistan Ranks 33rd in Global Debt

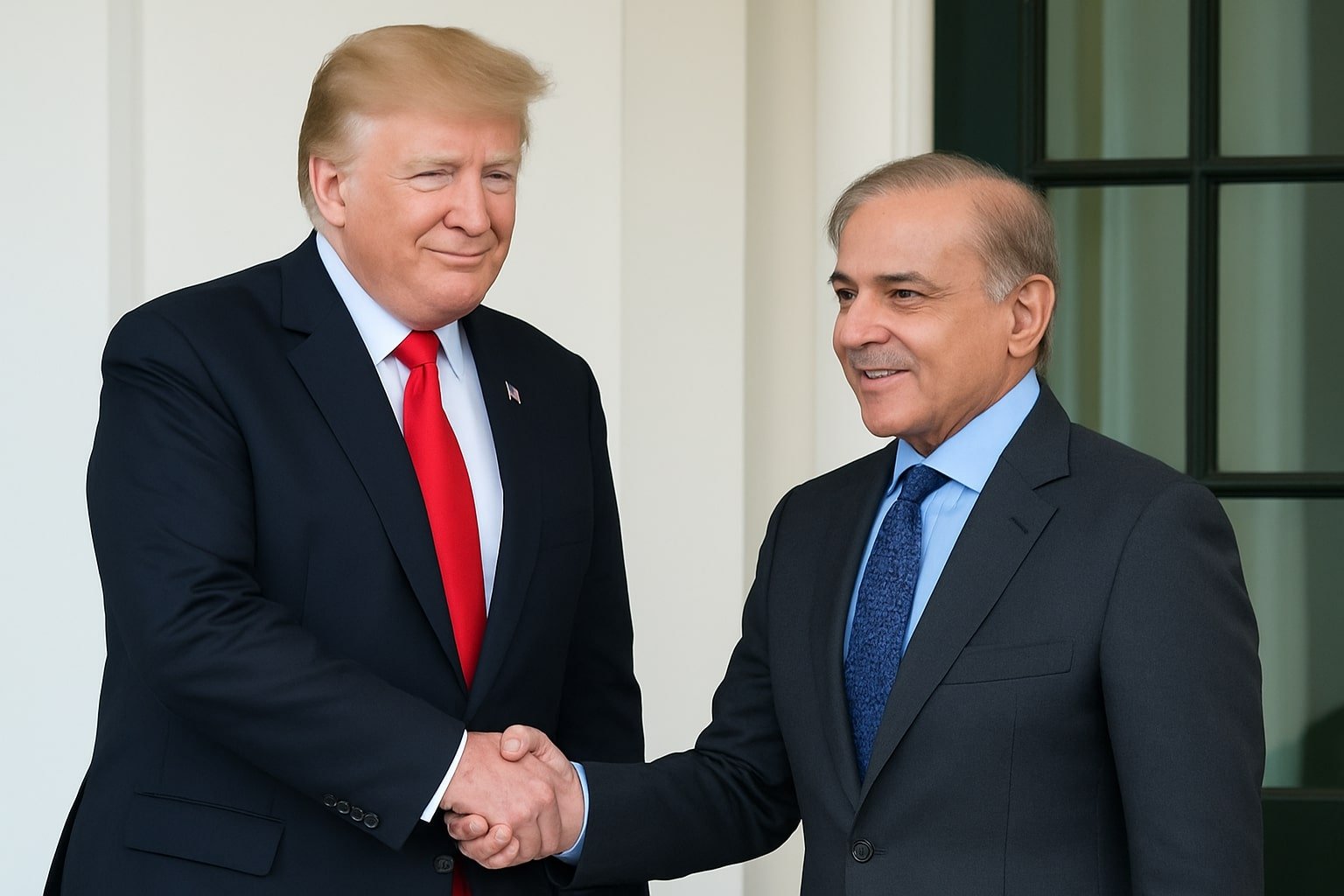

Pakistan’s 33rd position with $260.8 billion in debt represents 76% of its GDP, a heavy burden for a nation of 240 million. The US Most Indebted Country report places Pakistan behind India ($3 trillion, 7th) but ahead of Bangladesh ($177.6 billion, 42nd). Pakistan’s debt, including external loans from China and the IMF, has risen 12% in 2025, per the State Bank of Pakistan, due to flood recovery costs and energy imports.

The US Most Indebted Country analysis shows Pakistan’s per capita debt at $1,087, lower than the US but pressing for low-income households. The context frames Pakistan’s struggle, where debt servicing eats 40% of the budget, limiting spending on health and education. The report calls for fiscal reforms in Pakistan to curb borrowing.

Global Debt Rankings: A Snapshot

The US Most Indebted Country leads the pack, followed by Japan (10.5 trillion, 2nd), China (10.2 trillion, 3rd), the UK (3.5 trillion, 4th), and France (3.2 trillion, 5th). The debt-to-GDP ratio of 123% tops Greece’s 170%, but the US’s absolute figure dwarfs all. Pakistan’s 33rd spot reflects a $260.8 billion load, with 65% external debt, vulnerable to rupee depreciation.

The US Most Indebted Country report reveals 86 countries owe over $162 billion to the IMF, with Pakistan among them, owing $7 billion. The analysis warns of a global debt crisis, with developing nations like Pakistan facing higher interest rates on loans.

Public Reaction and Social Media Buzz

The US Most Indebted Country report ignited a firestorm on X on October 18, 2025. Americans worried, with one posting, $33T? Time to cut spending!” Pakistanis reflected, “Pakistan 33rd in debt dwarfs us!” Hashtags like #UnitedStatesMostIndebtedCountry trended, with memes comparing US debt to Pakistan’s.

Global users debated, with one noting, “US Most Indebted Country still the world’s bank?” The buzz reflects anxiety over debt, with the sparking calls for reform.

Challenges Amid the Debt Burden

The US Most Indebted Country status poses risks like higher interest rates and reduced spending on infrastructure. The debt service could reach $1.7 trillion by 2034, crowding out social programs. For Pakistan at 33rd, the US Most Indebted Country context amplifies its struggle, with $20 billion annual debt payments straining the budget.

The US Most Indebted Country report warns of a debt trap, with Pakistan’s 76% debt-to-GDP ratio vulnerable to shocks. The analysis urges fiscal discipline, but political pressures complicate reforms.

A Glimmer of Hope

The US Most Indebted Country report, while alarming, sparks dialogue on solutions. The status inspires fiscal responsibility, with calls for tax reforms and spending cuts. For Pakistan at 33rd, the context motivates growth, with exports up 15% in 2025.

The US Most Indebted Countryhighlights resilience, as nations like Japan manage high debt with strong economies. It’s a call to action, making a catalyst for change.

What’s Next for the United States Most Indebted Country?

TheUS Most Indebted Country debt will likely grow to $45 trillion by 2033, per CBO projections. The report calls for bipartisan action, with a debt ceiling raise expected in 2026. For Pakistan at 33rd, the context urges IMF-backed reforms to stabilize debt.

Nations are urged to monitor fiscal health and advocate for sustainable policies. The US Most Indebted Countryis a warning and opportunity, fostering global fiscal dialogue. Stay tuned for updates on the and debt trends.